The Bank of Canada has decided to maintain the nation’s key interest rate at 5% for the sixth consecutive time since last July, reflecting a commitment to a steady and cautious approach in the face of global financial volatility. This decision highlights the importance of timing and patience in economic policy, and its implications for everyday Canadians who are navigating a constantly changing economic landscape while managing bills, aspirations, and future plans. Let’s explore this topic in further detail.

Why Does the Bank of Canada Maintain a Steady Rate?

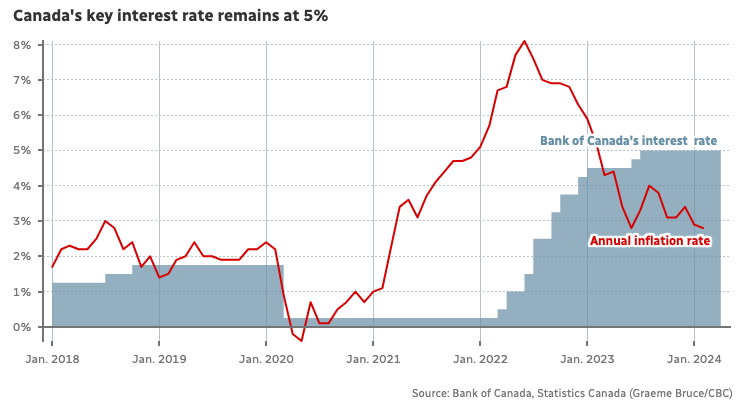

Managing inflation is a crucial objective for central banks worldwide in the intricate realm of economic indicators. Despite the challenge posed by inflation, which saw a 2.8% increase in February, the Bank of Canada has spotted a ray of hope. Core inflation, which excludes the volatile food and energy sectors, has shown a gentle decline in recent times. Nevertheless, Governor Tiff Macklem is approaching the situation with caution and favoring a wait-and-see strategy. The policy is clear: “Seeing is believing, but patience is key before any celebration.”

The Future of Interest Rate Reductions: Exploring Potential Outcomes

The possibility of a rate cut spreads optimism across numerous sectors, including the lively real estate market and consumers considering loans. Governor Macklem suggests June might mark a significant shift. Yet, the focus extends beyond the immediate future, aiming to transform these inflation trends from temporary visitors to permanent fixtures within the economic terrain.

The Unavoidable Reality of High Living Costs

Even as inflation cools, Canadians continue to feel financial pressures, especially from soaring rent and mortgage interest rates that significantly dent their monthly budgets. The Bank maintains a cautiously optimistic forecast, anticipating that inflation will gradually approach its preferred 2% target by 2025. This outlook is supported by projections of strong GDP growth, driven by surges in population and vigorous consumer spending.

What’s Next For The Bank Of Canada?

Since March 2022, the central bank’s journey has resembled a rollercoaster, marked by a succession of rate increases intended to tame the wave of inflation. As we find ourselves on the verge of possible rate reductions, the pressing question is: How much longer will the current rate be maintained?

Exploring Global Perspectives: Contrasting Canada and the United States

Economists closely watch the Bank of Canada and the U.S. Federal Reserve, analyzing their next strategies in the intricate global economic chess game. As the U.S. economy showcases robust growth beyond expectations, Canada takes a cautious approach, expertly navigating the delicate balance between economic recovery and stability.

As we brace for what the future holds, questions about managing finances in fluctuating economic times become more pertinent. From budgeting wisdom to financial planning pearls, the conversation around navigating through inflation is more crucial than ever.

In Summary: A Firm Vessel Amidst Choppy Seas

The Bank of Canada has recently revised its interest rates with a cautious approach, waiting to see how things unfold. This strategy highlights the significance of maintaining steady progress towards economic stability. Although there could be potential rate reductions in the future, Canadians can remain cautiously optimistic while focusing on their financial preparedness and strength.

Understanding the economic trends is crucial when it comes to the real estate industry. If you’re planning to invest in real estate, it’s important to consider seeking advice from professionals. Almasi Real Estate can provide you with invaluable insights and guidance, enabling you to make informed decisions during these constantly changing economic times.